Partners.

Founded in 2003 in Denver, Colorado, Bow River Capital was established with a vision of building a world class, diversified investment management platform focused on the lower middle market. Bow River Capital is employee-owned and has five private fund platforms: Private Credit, Private Equity, Real Estate, and Software Growth Equity and the Bow River Evergreen Strategies, which you can learn more about here.

50

Employees

$3.0BN

AUM

This number is prepared by Bow River Capital and reflects regulatory assets under management. It has not been audited, confirmed, or otherwise verified by any third-party.

The Bow River Difference

Partners

We work collaboratively with our portfolio investment partners with the shared goal of building enduring businesses and properties.

Hands-on Operators

We get close to the businesses and properties we own and leverage our industry expertise to create value. We bring a clear, consistent and repeatable process to maximizing each investment opportunity.

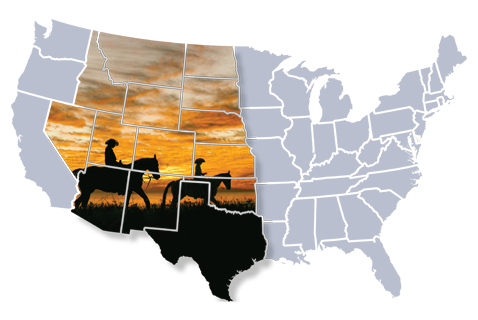

Rodeo Region Focused

Our primary geographic investment focus is the Rocky Mountain West and Southwest, an area that we refer to as the Rodeo Region. We've found that business owners and management teams in the Rodeo Region have values that are similar to ours, resulting in strong partnerships and a shared vision of success.

Internal Operations Team

With dedicated finance, compliance and operation teams, Bow River Capital combines the innovation, nimbleness and partnership of a boutique investment firm with the capability and commitment of institutional-quality operational support.

“The Rodeo Region continues to punch far above its geographic weight in economic growth and offers the potential to produce exceptional returns in our investment strategies."

Rick Pederson, Vice Chairman & Chief Strategy Officer

If you are interested in having Rick Pederson speak to your group about the Rodeo Region, please send an email to info@bowrivercapital.com.

Alignment Of Interests

Bow River Capital is employee-owned and we make substantial investments in our funds, aligning our success with our management teams and investors.

For Founders, Owners and Management Teams

Bow River Capital works with founders, owners and management teams to evolve strong businesses and increase enterprise value. Contact us if you are:

What’s in the Name?

Bow River Capital is named after the Canadian Bow River. Our Founder, Blair Richardson, was born in Canada and was struck by the beauty of the river and its surroundings. In 2003, he chose the name “Bow River Capital” to represent the strong values of the Rocky Mountain West and the world-class investment firm he and his colleagues would build in the Rodeo Region.